Tokenomics and Mechanics

TOKENOMICS

-The 10% buy tax goes into a service wallet, powering the investment treasury!

-The 10% sell tax, burns every single $OBURN, making it a hyper-deflationary token!

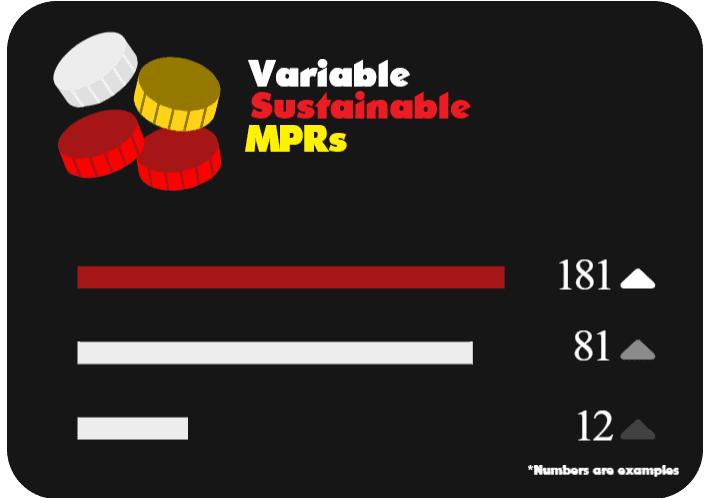

-Stake your $OBURN in Tinder when it’s released to earn a guaranteed variable Monthly Percentage Rewards! (vMPR)

-Not only is $OBURN hyper deflationary, but we will be leveraging our treasury profits to grow the price of $OBURN! So that there is outside revenue buying back $OBURN to increase the price!

Tinder Pool Mechanics

Our investment treasury farms revenue across various defi yield strategies, trading, and blue chip holdings.

50% of the yield generated by the treasury, is deposited into the Tinder staking pool each month, allowing $OBURN holders to single stake their $OBURN to earn a locked-in vMPR (variable monthly percentage rewards)!

Each 30 day lock cycle’s earnings are pre-determined by revenue generated the previous month- No guess work!

Token

Distribution

Token Distribution as of 06/23

67.1 Billion Current Circulating Supply

95.2 Billion Already burnt to the dead wallet through deflationary mechanics

500 Billion Locked in Gnosis Safe for ecosystem expansion

150 Billion Locked in Gnosis Safe for pairing with BUSD revenue to deepen Liquidity

100 Billion Locked in Gnosis Safe for future ecosystem expansion

50 Billion Locked in Gnosis Safe for Future exchange liquidity

37 Billion Locked in Gnosis Safe – Marketing, Vested Team Allocation, Partnerships

HOW IT WORKS

Tier 1

1000

Supply cap

0%

Owning a Flame Cultist eliminates the deposit fee for Tinder

$100

Cost during Stage 1 Minting

Tier 2

500

Supply cap

2.5%

vMPR boost

$250

Cost during Stage 1 Minting

Tier 3

250

Supply cap

2.5%

vMPR boost

$400

Cost during Stage 1 Minting

We are keeping the NFT supply LOW,

to help ensure a strong secondary market demand as our protocol grows. There will NEVER be any additional vMPR boosting NFTs minted after this. You will be able to select what NFT tier you’re wanting to mint, when mint time begins, as we will utilize separate contracts for each tier.

Tier 1 NFTs waive the small burn fee to stake your $OBURN in the Tinder staking pool!

Tier 2 NFTs boost the vMPR you receive for staking $OBURN by 2.5%!

Tier 3 NFTs boost the vMPR you receive for staking $OBURN by an additional 2.5%!

You can stack your vMPR boosting NFTs!

You will be able to stake up to three Tier 2 and three Tier 3 NFTs, to boost your vMPR received by a total of 15%! Due to the incredibly limited supply of the Tier 3 NFTs, only 83 people would ever be able to get the full max stack of three Tier 3 NFTs to boost their vMPR by the maximum amount!

OBURN Price Appreciation

Price Appreciation for $OBURN

Not only is $OBURN hyper deflationary, but as the yield increases from the Tinder Pool, the fair value for $OBURN increases!Future Treasury Mechanic

50% of the treasury farming revenue goes to compounding the growth of the treasury. Not only does this increase the yield of Tinder, but when the treasury holdings reach certain milestones, we will begin using a large percentage of revenue to buyback the $OBURN token, raising the price!Benefits

In addition, as our price grows, we will pair fresh money with more $OBURN in the liquidity pool. Over time, this will continue to residually force the price up, while deepening the liquidity pool to lessening the impact of any sells.Treasury

The mechanics of the treasury are designed in a way that enables us to have self-sustainability! The treasury purchases of $OBURN drive additional volume, price appreciation, and deeper liquidity!Flywheel!

The treasury is designed to increase the Tinder pool yield over time. This continually makes $OBURN an attractive option at any price point! As more holders buy $OBURN to take part in our Tinder pool, the buy tax feeds the treasury, which grows the yield!Investment Strategies

Here at OnlyBurns, we believe in being smart with our treasury investments, to ensure $OBURN is sustainable for holders indefinitely. The majority of our funds will be allocated to stablecoin farming, as well as utilize Overnight Finances ETS hedge system, so the treasury can grow even during a bear market. We will also be utilizing Uniswap V3 exotic strategies as an additional growth aspect for our treasury. A smaller percentage is allocated towards blue chip crypto growth. A very small percentage is utilized to invest into promising startup protocols during their seed funding round. Safety of funds is our priorityROADMAP

Token presale

Token Launch

Mega Buyback and Burn Event!

Stage 1 NFT sales!

Strong advertising push!

Tinder Staking Pool Released!

Protocol partnerships!

Stage 2 NFT Sale

Treasury activates Price Appreciation for $OBURN!

NFTs begin BUSD drip from treasury profits!

Relationships and Partnerships

Relationships and Partners

OnlyBurns has formed several relationships and mutually beneficial partnerships prior to even launching! To learn more about our friends, visit their websites!

KyotoSwap – https://kyotoswap.io

Sphere Finance https://sphere.finance

Moeta – https://www.moetatoken.com

ChainBet – https://chainbet.gg

Core Team

Founder, Cyril Keir

Cyril Keir has been in business management for over 16 years, and has 13 years of portfolio management. He operates a Defi Consultation firm called KC Consulting, assisting other protocols with their tokenomics, utilities, and business structure.

Lead Developer, Sam Slivinski

Sam Slivinski is a member of Obsidian Council, and has been a developer for many years. He owns and operates a successful parts machining company as well.